Dad’s banks challenged by neo-banks

After the hotel business with AirBnb, taxis with Uber, food deliveries with Deliveroo and many other industries where pure players have shaken up the established order with new business models, it is now the turn of banks to be challenged. Digital competitors are emerging in the financial sector with mobile apps attracting users. While we are not about to see Dad’s generation of banks collapse, it is in their best interests to learn what appeals to users most about these new digital banks and their efficient and creative apps.

Nicknamed “fintech” (short for ‘financial technology’), these pure players actually provide services for which the overwhelming majority of us still trust traditional banks, often for want of anything better. While these remain essential to the general public for regulatory reasons as well as, among other things, for services such as mortgages, credits and other “traditional” activities in the sector, competition is intensifying in other areas where they used to enjoy a monopoly. While these new banks and their applications cannot (yet) replace traditional institutions, they are so far ahead in terms of user experience, ergonomics and features that it is surprising they have not yet been set up as banking industry standards. Here’s a non-exhaustive overview of the fintechs that have caught my eye:

N26, the first neobank operating in Belgium

Honour to the pioneer in Belgium: N26. Having obtained a German banking license in 2016, this online bank offers an app and a web version accessible from other devices. Among its many advantages, which immediately overshadowed traditional bank applications and became fintech standards, are the secure fingerprint or FaceID connection, the implementation of Apple Pay and full control of your Mastercard via the app (changing spending and withdrawal limits, activating or deactivating payments abroad, changing PIN code, blocking the card, etc.), all in a totally secure way (3DS).

Allowing you to have a real IBAN account, N26 informs you by push notification of any activity on your account and allows international transfers in 19 currencies. The ability to assign a category to all your transactions provides a crystal-clear statistical overview of your finances, automatically categorized by artificial intelligence, before exporting them in CSV format for the benefit of your accountant. N26 is available in English, French, German, Spanish and Italian, regardless of your country of residence. Apple Pay and Google Pay are both available for N26 in Belgium.

Revolut, the fintech revolution

Revolut is currently the leader in the fintech market both in terms of the number of customers and the scope of its functionalities. After creating your British IBAN account (in euros, pounds, dollars or Romanian lei) in a few minutes from the application, you are now a customer. You can then create temporary virtual cards, convenient for “trial” online subscriptions requiring a bank card, or to limit your expenses to a specific budget for a trip. Revolut also allows you to buy and exchange five cryptocurrencies (Bitcoin, Litecoin, Ethereum, Bitcoin Cash and XRP) and to receive notifications when they reach the value of your choice. Exclusive concierge services, LoungeKey access, insurance (for your luggage, delayed flights and medical expenses abroad) and international delivery are also available.

The ultimate: bunq

In terms of technology, creativity and user experience, bunq stands out clearly from its competitors: like the two brands mentioned above, its application allows you to fully manage your accounts, their settings and features. A true Dutch bank, bunq is compatible with Apple Pay, allows the use of other currencies free of charge, up to 10 withdrawals per month worldwide, real exchange rate transfers via TransferWise, up to 25 single IBAN accounts to better manage your budgets, customisable automatic savings, virtual cards.

Particularly useful: joint accounts configured with a single click for household expenses (with full shared access), for example, or to allow your accountant to access your business account (with restricted access where you must validate transactions). It is also possible to make transactions from 2 different accounts from the same card to which 2 different PIN codes have been assigned. Allowing the automation of payments via structured files, the automatic recognition of transfer forms and the automatic encoding of invoices from a scanned file, bunq greatly facilitates the management of professional accounts.

In addition, the payment links to be sent as reminders are very effective, the ergonomics of the app are extremely well thought out, the gamification approach makes it easy to discover features, and it is possible to choose how bunq invests your money: exclusively in green companies, in personal loans or via the ECB. Its open API, which opens the door to a world of custom applications related to your account, or authentication via the recognition of your hand’s blood vessels, are among the many cherries on the Dutch bank’s cake.

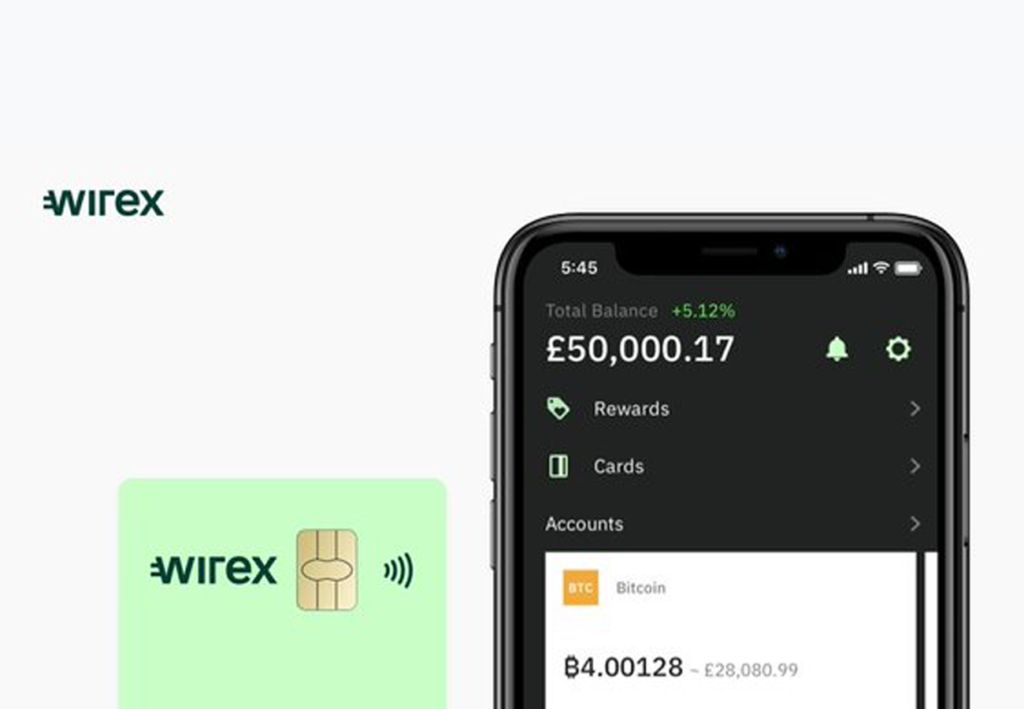

Spend your cryptocurrencies easily with Wirex

Wirex is a slightly different concept: more than a real bank, its originality and usefulness are based on the concept of a cryptocurrency’s portfolio, allowing 18 traditional and digital currencies to be managed from a single platform. While users are naturally dependent on the conversion times specific to the different cryptocurrencies, they do benefit from real-time rates, and above all can spend them at this rate from a Visa card. This is particularly effective since it is still exceptional to be able to pay for a transaction via a cryptocurrency transfer, while Visa card payments are possible everywhere online and in most physical points of sale that accept credit cards.

Holvi: the SME’s best friend

Holvi is a Finnish bank for entrepreneurs and freelancers, offering them all-in-one management of their accounts and accounting and even an integrated e-commerce service: in a few minutes, your online shop is launched, including payment and invoice management. All paperwork is simplified and centralised, as well as your expenses, via the Mastercard linked to your account. Creating and managing your SME has never been easier, and thanks to the Estonian concept of e-Residency, entrepreneurs from all over the European Union can go through Holvi to escape the tedious traditional administrative processes and create their business quickly, securely and legally. All this, while seeing their e-commerce go from project to success in less time than it takes to unlock your SIM card with some phone operators.

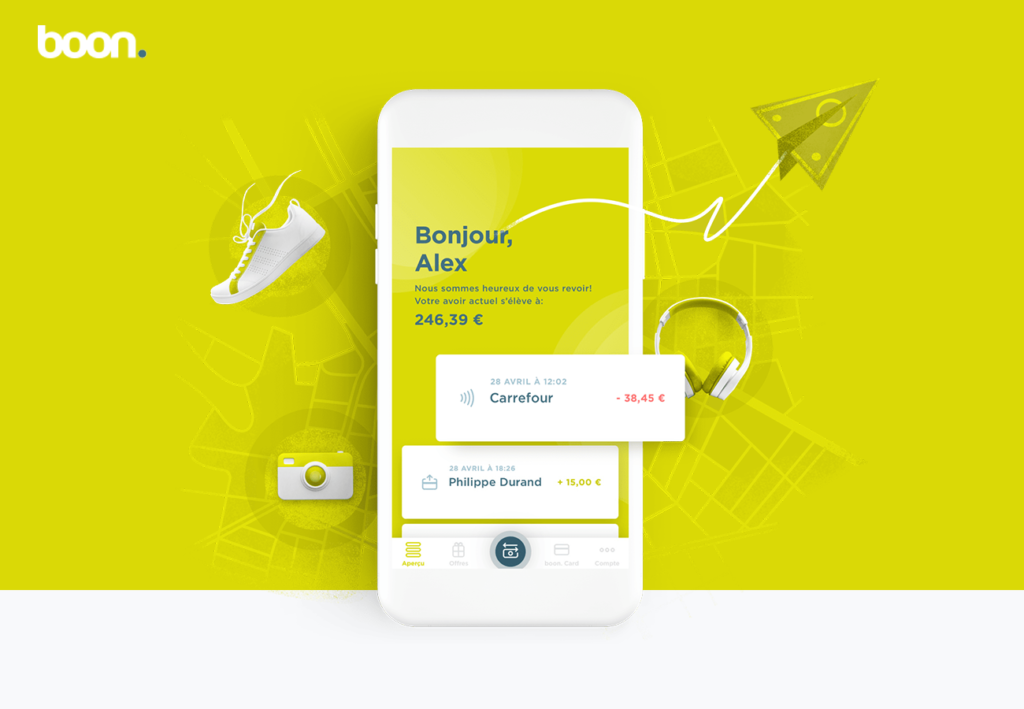

Paying with a wrist stroke thanks to Boon

Other useful apps include Boon, produced by the German company Wirecard, which creates a virtual prepaid Mastercard to allow you to use Apple Pay, Google Pay, Garmin Pay and Fitbit Pay with your credit card – even if your bank does not yet allow it. All you have to do is feed this virtual card to be able to spend your money with a gesture of your wrist.

One Curve to rule all your credit cards

And let’s not forget Curve, an application that allows you to group all your Mastercard and Visa credit cards into a single physical card, and to choose the one you want to use via the application. This card emulator also simplifies the management of your expense reports and offers a cashback program on your expenses, like most of the applications presented in this article.

Years of delay to be bridged

After this list of features, we can see that our Belgian banks are still far from meeting users’ expectations in terms of banking experience. It is becoming more and more tempting for customers to abandon the primitive apps of historical Belgian banks in favour of these new banks in step with the modern world. The time savings in administration and accounting alone, not to mention avoiding misadventures abroad that leave you moneyless due to the lack of an efficient app and customer service, show how far Dad’s banks are lagging behind.

Fortunately for them, old-fashioned banks still offer services that users can hardly do without, such as loans, mortgages and others. Because otherwise, they would see their customers slip through their fingers in less time than it takes to transfer money between two competing traditional bank accounts…